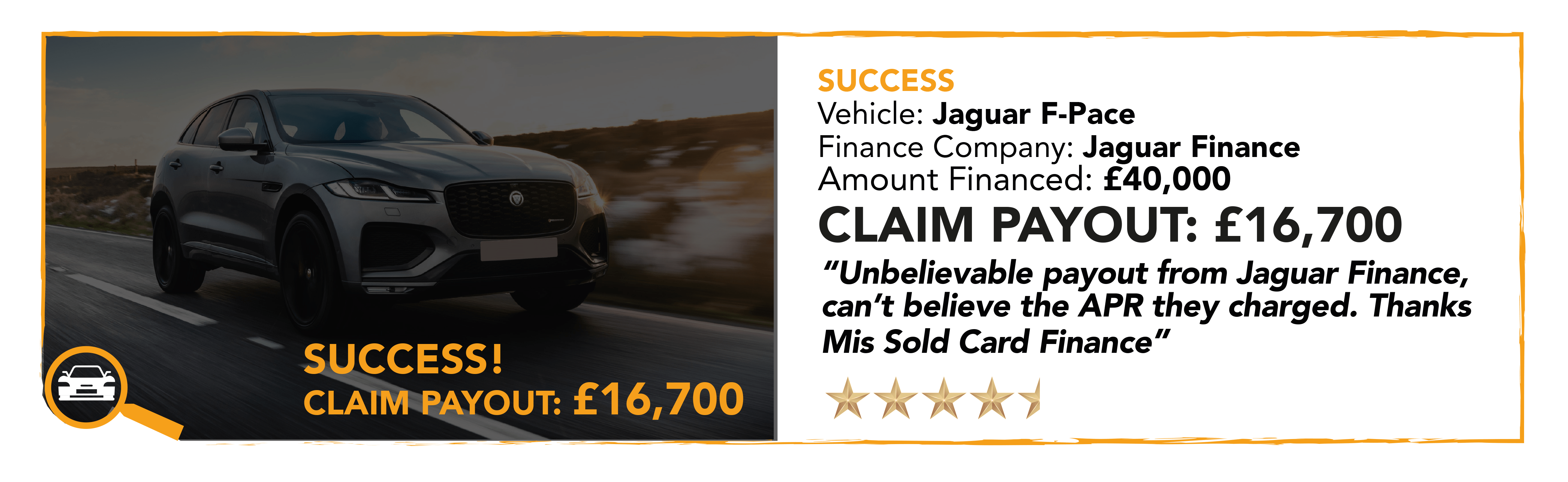

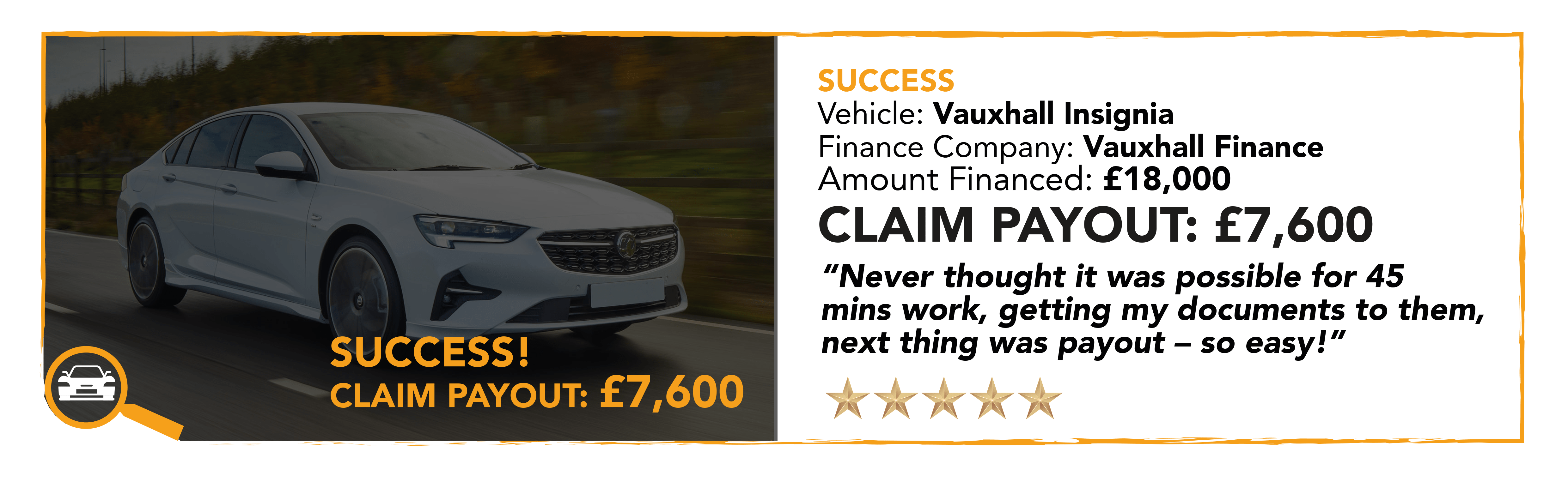

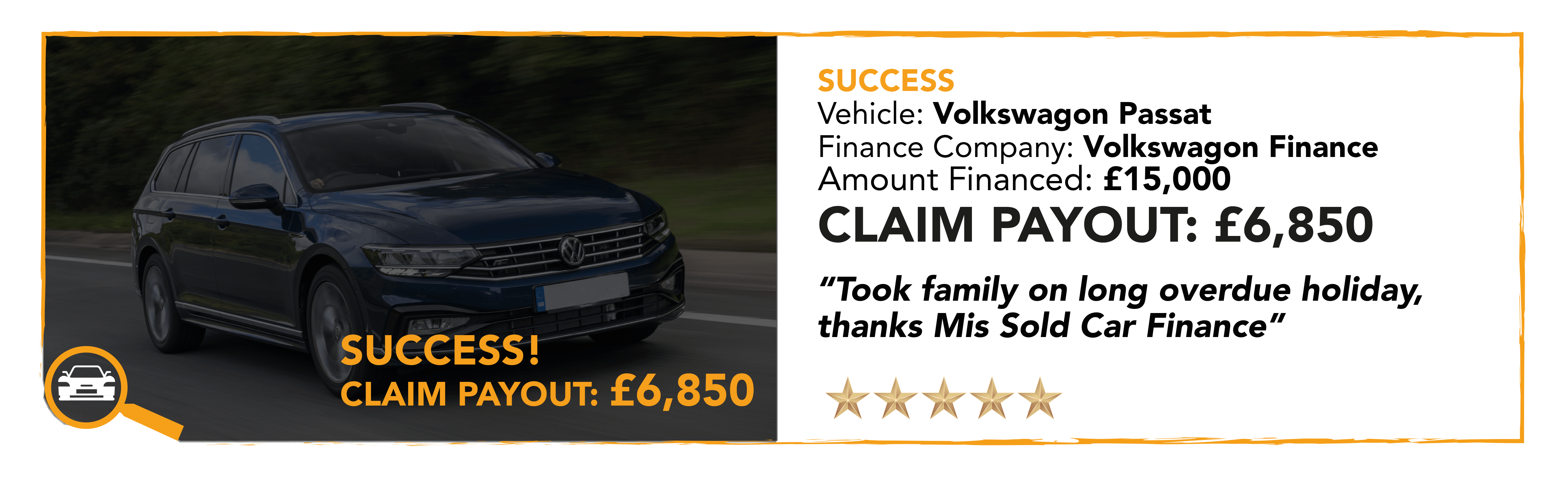

This depends on the amount that you financed and the APR, generally the higher the amount financed the larger the amount of claim. Whether you had a PCP or Hire Purchase our average pay-out on vehicles £25,000 and over is £13,500. Our average pay-out on vehicles under £25,000 is £8,300. Want to know how much your claim could be worth, Hit the button below and get a valuation in less than 10 seconds.

What do I need to do to get my money back?

It’s simple… Take ten seconds to fill out our instant valuation form to figure out your claim value, then hit the ‘Start your claim’ button to get started. Once you’ve started your claim you will be asked to provide the following information to proceed with the claim:

Name

Email Address

Phone Number

Finance Agreement (Copy)

Proof Of ID (passport or driving licence)

Proof Of Address (within the last 2 months)

It should only take 10-15 minutes to gather and submit these documents to our system, at which point your claim would be passed on to our solicitors who would take it forward from there. They do all the hard work for you and pay for all costs while you sit back and wait for your money to drop (we have a 95% success rate on our cases)!

No Win, No Fee, No Risk

We work on a no-win no fee basis, therefore, you won’t pay a single penny unless you have a successful claim. At Mis Sold Car Finance, we work with the UK’s top solicitors. Therefore, we have a 95% success rate. We will cover all costs up until you have a successful claim. So, what are you waiting for? As there could be a limited time to submit your claim. Hit the button below to get your instant valuation and get your claim started!

About Us

Hi, I’m James, Founder and CEO Of Mis sold Car Finance I have owned and operated a number of car dealerships and have 35 years’ experience in the motor trade and finance industry – not to mention relationships built up with some of the top solicitors and legal companies within the UK.

Over these 35 years, I’ve bought and sold thousands of cars. I was also approved by the FCA and was able to offer finance in various forms from PCP, HP, leasing so have a full knowledge of the industry and how it works.

FAQs

How was I mis-sold?

A – If you have had a car finance agreement either PCP or HP between the dates of 1st of April 2014 and the 31st of December 2019 according to the FCAs own report there is a 92% chance you have been mis sold that agreement either through hidden commissions or excess milage.

It’s a no win no fee, right?

A – 100% no win no fee, so you don’t have to pay a single penny until the claim is successful.

There is no chance of me getting a bill even if I lose the case is there?

A – no not at all this is completely no win no fee, our team of solicitors have what is called an ATE in place (After the Event Insurance) that’s put in place to cover any costs of your claims, so you don’t have to pay a thing.

How do I know if I am eligible for a claim?

A – if you have had a car finance agreement either PCP or HP between the dates of 1st of April 2014 and the 31st of December 2019 according to the FCAs own report there is a 92% chance you have been mis sold that agreement either through hidden commissions or excess milage.

How quickly will I get paid out?

A- our average pay out is between 3 months to 9 months regardless of the finance company once we have all your required documents, we start the process straight away.

Contact Details

Mis Sold Car Finance is a trading style of Park Pension Recovery Service Ltd

Registered office: Woodside Place, Glasgow, G3 7QF, United Kingdom. Company Registration Number SC630142. Park Pension Recovery Service Ltd is authorised and regulated by the Financial Conduct Authority (FRN:836153). Registered with the Information Commissioners Office registration number: ZA587266

We are Partners with trusted Solicitors and Claims Management Companies (CMC’s). There is absolutely no upfront fee to submit a claim.

If your claim is successful, then only a percentage of the compensation will be deducted by the Solicitor or CMC that is handling your claim. The exact percentage will be outlined when they contact you shortly.

Mis Sold Car Finance.com is owned by James Doyle T/A Mis Sold Car Finance